Did you have a savings account when you were young? It wasn’t uncommon and those old Passbook accounts funded many a first car.

Now you’re a parent, are you thinking of opening an account for your kids? Record low-interest rates have taken some of the fun out of watching bank accounts grow, but there are alternatives.

For example, have you considered a share portfolio?

Direct shares follow market movements, whether that be up or down, but over time, quality shares have greater growth potential than many other investment types.

For a child’s investment fund, you’re probably looking at a savings term around 15 to 20 years – ideal for riding market ups and downs.

When Lincoln was born, his parents discussed possible long-term investments with their financial planner and settled on a portfolio of diverse assets suitable for a 15–20-year time horizon.

Meanwhile, Lincoln’s grandparents chose to open a traditional savings account at their preferred bank.

How did the two compare?

Consider the following example

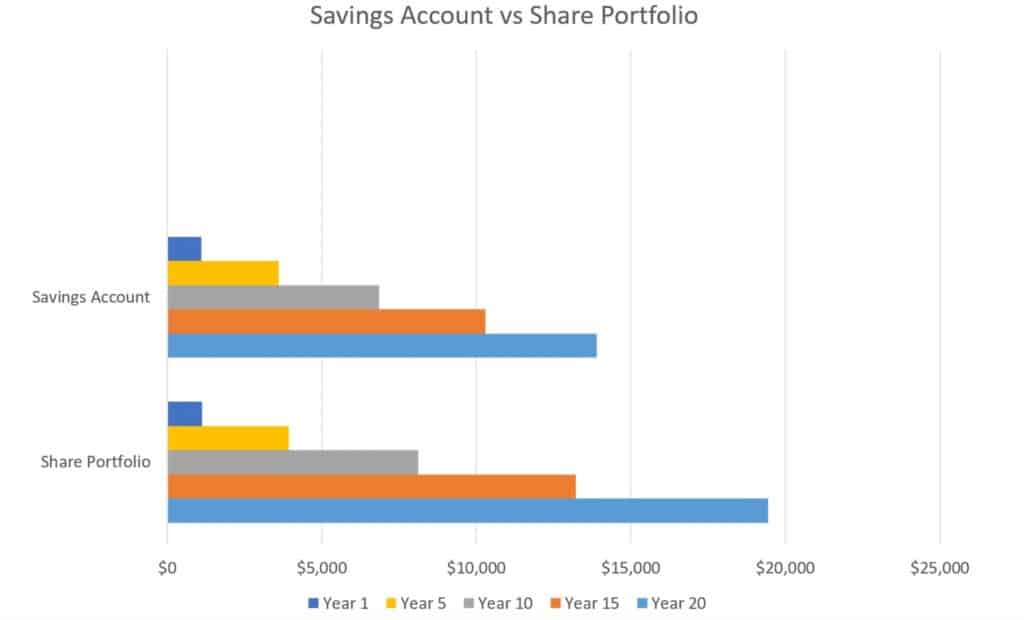

Initial investment: $500

Monthly contribution: $50

Investment term: 20 years

Assumptions: Savings account return calculated on 1% per annum interest. Share portfolio return 4% per annum based on a comparison of mixed Balanced Asset funds over the past three years to December 2020.

This example demonstrates how shares, year-on-year, can potentially outpace a savings account. By year 20, Lincoln’s projected Savings Account balance was $13,899 and his projected Share Portfolio balance was 19,450.

Straight-forward? Not so fast, as here are a few other points to think about.

Tax and TFNs

Your child can have a tax file number (TFN) – there’s no minimum age. All funds will request a TFN, but whether you quote the child’s TFN or your own depends on a number of factors like who is contributing to the investment, whether the money is being used, etc.

Tax is tricky too. Your child’s age and whether they’re earning their own money will determine whether they have an income tax liability and need to lodge a tax return.

Additionally, there’s Capital Gains Tax (CGT). Share portfolios are assessed for CGT if the assets are sold for more than their purchase price. The amount of CGT payable will depend on a number of elements, but your tax agent will be able to assist.

There will always be tax, but how much, what type and how it is calculated will depend on your, and your child’s, circumstances.

Do your sums to work out the most suitable tax outcome for you and your child. Remember that mistakes can be costly so it’s wise to consult a tax accountant for personalised advice.

Trusts

Many people consider setting up a trust for the children’s savings, as it helps to protect the assets in the child’s name. There are two types of trusts and they’re quite different.

Trust accounts are accounts held at a bank that you open for your child, but you retain ownership. When the child turns 18, control of the account passes to them.

Trust funds are legal arrangements, managed by trustees for the child’s benefit. They’re generally used for substantial investments and the child can access the assets once they attain a certain age.

Where trust funds are concerned, forget everything you thought you knew about tax and speak to a professional with expertise in family trust arrangements.

Everyone’s situation is different and investment types and structures are not one-size-suits-all. Before making any decisions, seek the advice of qualified professionals, and regardless of whether you choose a share portfolio or an alternative investment, you’ll be across your options and confident that your particular needs are being met.

The purpose of this website is to provide general information only and the contents of this website do not purport to provide personal financial advice. Denaro Wealth strongly recommends that investors consult a financial adviser prior to making any investment decision. The contents of the Denaro Wealth website does not take into account the investment objectives, financial situation or particular needs of any person and should not be used as the basis for making any financial or other decisions. The information is selective and may not be complete or accurate for your particular purposes and should not be construed as a recommendation to invest in any particular product, investment or security. The information provided on this website is given in good faith and is believed to be accurate at the time of compilation.